Embrace the Collective:

Hispanic Digital Purchase Behaviors

Thank you for your interest in our study. To learn more about our findings, please read below. Also, we will be publishing a White Paper before year-end. If you’d like to receive a copy, please fill out your contact information. Enjoy!

I. SEARCH

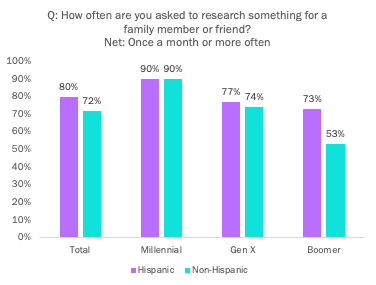

- Hispanics are more likely than non-Hispanics to assist others with product searches.

- Millennial Hispanics are most likely to be assisting in search.

- Hispanic Gen X and Boomers are more likely than non-Hispanic Gen X and Boomers to assist with search.

- Medium Acculturated Hispanics (85%) are asked more than Low Acculturated Hispanics (83%) and High Acculturated Hispanics (73%) to assist with searches.

- While English is the preferred search language across acculturation levels, Spanish is also used, and sometimes both.

Key Findings: Hispanic online behavior mirrors their offline behavior. Their usage of languages and their collective ethos is reflected online as well.

Brand Implications: Brands need to assume that their primary target isn’t the single decision maker and that marketing to others in the Hispanic community will better serve their objectives.

II. DOMESTIC AND INTERNATIONAL SUPPORT

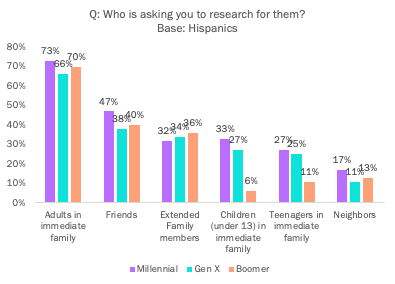

- Millennial Hispanics are helping a wide variety of friends and relatives with purchases, while Boomer Hispanics are the most likely to be helping extended family members.

- Across acculturation cohorts, Medium Acculturated Hispanics are the most likely to be helping someone in their own household (64%), while High Acculturated Hispanics are most likely to be helping someone living outside their household but in the US (68%), and Low Acculturated Hispanics are the most likely to be helping someone living outside the US (18%).

Key Findings: Hispanics are helping family members and friends in their households, outside of their households, and outside of the U.S. search for products/services.

Brand Implications: Brands need to have marketing assets available in Spanish and English to better serve the needs of the community and further the brand message organically. Additionally, for international brands, this finding has deep implications relative to early word of mouth and seeding the marketplace for new product launches and distribution.

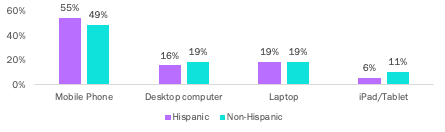

III. MOBILE PREFERENCE

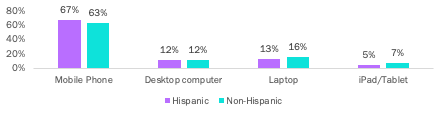

- Hispanics are more likely than non-Hispanics to use their mobile phones for searches throughout the day and evening, with even higher mobile usage levels throughout the day for younger consumers (both Millennial and Gen X) and Low Acculturated Hispanics.

MORNING

AFTERNOON

EVENING

Key Finding: Across all levels of acculturation, and age cohorts, mobile phone is the primary search mechanism throughout the day/evening.

Brand Implications: Mobile campaigns and mobile optimized sites and experiences are a must to reach and engage the Hispanic market.

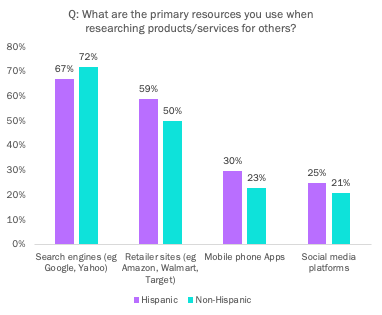

IV. DISCOVERY: SITES

- Hispanics are more likely to use retailer sites and less likely to use search engines when compared to non-Hispanics.

- Hispanics are also more likely to use mobile phone apps and social media platforms when researching for others.

- Across acculturation levels the differences are interesting, with 64% of Low Acculturated Hispanics using retailer sites, 52% primarily using search engines, 33% mobile phone apps and 30% social media sites.

- The Low Acculturated are most likely to use social media platforms (30%), and along with the Medium Acculturated (14%/each), most likely to turn to social media influencers for product information.

Key Finding: Non-Hispanics use search engines more than Hispanics, but Hispanics across age cohorts rely on search engines as their primary search tool with the Low Acculturated leaning toward retailer sites, first and foremost.

Brand Implications: Search difficulties and not language challenges are the primary reason consumers need assistance with search, so ensure search results have clear, concise dual language copy that can be shared intuitively on screen or via text or email.

V. DISCOVERY: CHALLENGES

- Language barriers are often a secondary concern when needing assistance with searches – Hispanics are more likely to say that it takes them longer to find the information (53%) or that they are technologically intimated (36%) more so than that they don’t read or understand English well enough (26%).

- Gen X Hispanics are the most likely to be searching in Spanish (28%) or a combination of English and Spanish (25%)..

- Boomer Hispanics (62%) are the most likely to search only in English.

| MILL (%) | GEN X (%) | Boomers (%) | Low (%) | Medium (%) | High (%) | |

|---|---|---|---|---|---|---|

| English | 55 | 47 | 62 | 18 | 51 | 93 |

| Spanish | 22 | 28 | 17 | 57 | 10 | 1 |

| Combination of both languages | 22 | 25 | 21 | 25 | 38 | 6 |

Key Finding: Across acculturation and age cohorts different languages are preferred for online searches.

Brand Implications: Brands should consider their search terminology and key words, ensuring that English, Spanish and a combination thereof, are used to facilitate the discovery journey for Hispanics across languages and generations.

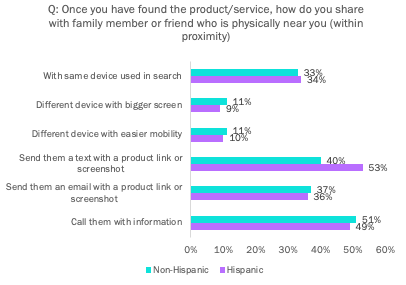

VI. SHARING SEARCH FINDINGS

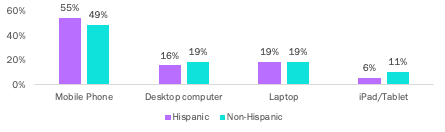

- Hispanics and non-Hispanics alike tend to share search findings with the same device used in search.

- Hispanics are most likely to send requestors a text with a product link or screenshot when compared to non-Hispanics– even if they are physically nearby.

- 73% of Hispanics report always or sometimes needing to translate for the person requesting the search.

- 31% of Low Acculturated Hispanics report ALWAYS having to translate results to someone.

- While all generations have a need to translate sometimes, Millennials are more likely to translate always.

Key Finding: When sharing information with others, Hispanic Millennial and Gen X are most likely to send text with a screen shot or product link.

Brand Implications: Brands need to facilitate the ability to share across levels of acculturation and linguistic proficiency to facilitate the influencer’s journey. Empowering consumers with media options for sharing should be considered as well, especially for the High Acculturated who tend to be assisting relatives outside of their homes but in the U.S., and the Low Acculturated who are assisting folks internationally.

VII. ONLINE SHOPPING

- Hispanics are more likely to shop online for themselves (41%) vs. non-Hispanics (33%)

- Across acculturation levels, the Low Acculturated are most likely to shop online (45%) followed by the High Acculturated (44%); Medium Acculturated Hispanics report shopping both offline and online equally (47%)

- Top three sites for all acculturation levels: Amazon, Walmart, eBay

- Hispanics are more likely (60%) than non-Hispanics (49%) to shop at Amazon

- Non-Hispanics (23%) are more likely to shop at Walmart than Hispanics (16%)

- Millennial and Gen X Hispanics are more likely to prefer brands that have Spanish content online

Key Finding: The Hispanic market is online and purchases more online than non-Hispanics.

Brand Implications: Ensuring a brand’s online presence serves the holistic Hispanic market is paramount. All online assets (ads, blogs, videos, website, etc.) should support Hispanics across acculturation levels. Spanish and English language content should be available and easily accessible and shareable.

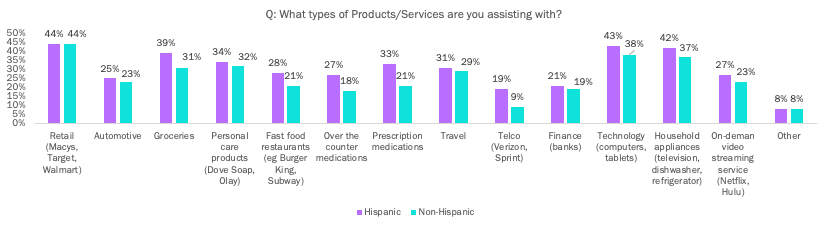

VIII. EVERYDAY PURCHASES

- Hispanics are more likely than non-Hispanics to be helping with everyday purchases, including categories like groceries, fast food, and both OTC and prescription medications.

- Hispanics are more likely to be assisting with purchases at lower price points – 70% of those assisting others are typically doing so for items costing under $100, compared to 59% for non-Hispanics.

- Across acculturation levels, Low Acculturated Hispanics (29%) are more likely than Medium and High Acculturated Hispanics to help with Telco and High Acculturated are more likely to help with automotive (33%)

- Low Acculturated are also assisting with Retail (50%), Prescription Meds (37%), Personal Care (36%), and Fast Food (35%)

- Medium Acculturated are more likely to assist with Tech (45%), Groceries (42%), OTC Meds (30%)

- High Acculturated are more likely to assist with Household Appliances (49%), Travel (34%), and Video Streaming (32%).

Key Finding: Assistance is needed with everyday purchases at lower price points. Most assistance is for purchases under $100, and for “everyday” shopping categories like groceries, fast food, and medications. That said, across acculturation levels, Hispanics are helping with different product/service categories.

Brand Implications: Brands in “everyday” categories and at lower price points should be as active in engaging the collective Hispanic shopper as those with higher ticket items, as consumers frequently seek help with what we might consider routine or everyday purchases. Furthermore, brand content should be readily available in Spanish and English, as those searching are sharing with a broader collective – especially in the areas of retail, personal care, fast food, and prescription meds.

In conclusion, it’s clear that the Hispanic market, while expansive, is not a monolith. Understanding the distinct generations, age cohorts, linguistic preferences, and device proclivities will go a long way in better targeting and discerning the Hispanic consumer cohort. That said, brands need to recognize that this community behaves collectively online. Their interdependence is brought to life in this study. Ensuring that a holistic approach is taken when driving awareness, engagement, and acquisition is paramount.